Lets checks out the potential 33.75% tax cost that can occur on lots of management acquistion offer structures.

The close company loan to participator tax charge (in CTA 2010, s 455) is a sensibly widely known part of our tax code. Extensively, where a loan or advance is made to a shareholder– commonly where an overdrawn director’s loan account arises– that has not been removed or paid back within nine months of the company’s year end, the company should pay a 33.75% tax cost on the quantity that remains exceptional. In practice, several overdrawn loan accounts are removed by the company making a bonus payment or a dividend payment to the director-shareholder within the nine-month repayment ‘home window’.

The section 455 fee is properly an anti-avoidance stipulation. Without it, shareholders would just be able to extract cash money from ‘their’ companies, without a tax fee, by obtaining the production of ideal loans to themselves. Thus, area 455 activates a regarded company tax fee of 33.75%– which is payable by the company– to the level that the loan is not paid off or cleared within the appropriate nine-month date (which, of course, accompanies when most companies pay their corporation tax).

Section 455 tax is repayable to the extent the loan is ultimately repaid. Nonetheless, if the loan is paid back after the nine-month period ends, the tax reimbursement only becomes due from HMRC 9 months after the end of the accounting period in which the loan is repaid.

Importantly, area 455 tax is regarded to be firm tax. Hence, despite the fact that it is repayable, it is subject to tax-based fines (for instance, failing to reveal an area 455 tax charge in the firm income tax return).

Extent of section 459.

Possibly less known are the supplementary stipulations taking care of ‘indirect loans’ to shareholders in CTA 2010, s 459. Generally, this arrangement regards a loan to have actually been made to a participator (usually a shareholder) where:.

● its under setups made by a person;.

● a close company makes a loan that is not within the regular CTA 2010, s 455 tax cost (e.g., a loan to a company); and.

●an individual (apart from the close company) makes a payment to a participator (or their affiliate), which is exempt to an income tax charge (CTA 2010, s 459( 3 )). This would be the case, for instance, where the participator or their associate obtains the money under the funding gains routine.

This regulation largely aims to capture certain ‘back-to-back arrangements’– such as where a close company down payments money with (say) a count on the understanding that the bank will certainly make an advancement or loan to a participator of that close company. These plans would strongly fall within this legislation.

Nevertheless, the phrasing of CTA 2010, s 459 is adequately large to catch ‘monetary assistance’ kind loans made about administration buyout bargains. This is finest illustrated with a typical management acquistion (MBO) case study.

MBO study

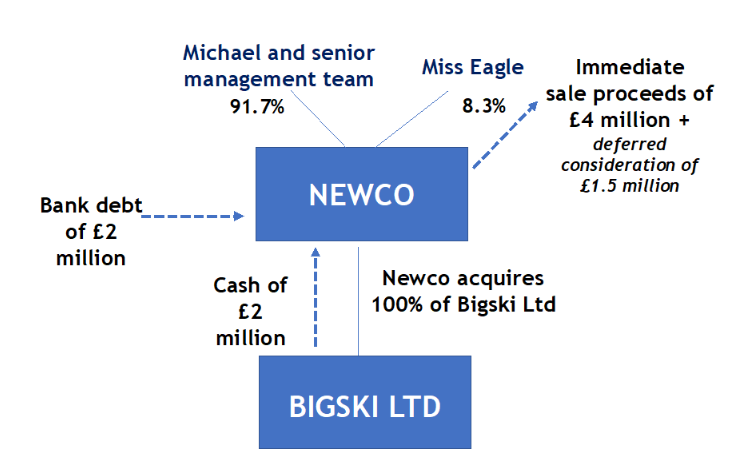

Miss Eagle, the 100% shareholder of Bigski Ltd, has actually consented to offer ‘her’ company to a new company (Newco) under an MBO deal, complying with the formation of Newco by Michael and the company’s senior administration group.

Under the MBO deal, Miss Eagle will market her 100% holding in Bigski Ltd for ₤ 6m. The ₤ 6m sale consideration would certainly be moneyed by surplus cash remaining in business (i.e., excess to its regular working capital needs) of some ₤ 2m, commercial bank debt of ₤ 2m, deferred consideration of ₤ 1.5 m, and shares in Newco (worth ₤ 0.5 m).

The company finance consultant has actually indicated that the ₤ 2m ‘excess’ cash ought to be passed to Miss Eagle by way of a loan from Bigski Ltd to Newco, as shown listed below:.

Under the above propositions, the loan made by Bigski Ltd to Newco is not within CTA 2010, s 455, considering that it is not to an individual participator (shareholder). However, under the MBO plans, the ₤ 2m loan cash develop part of the ₤ 4m sale continues quickly payable to Miss Eagle (the seller), which would fall within the resources gains tax regimen (i.e., an income tax-free kind).

Consequently, CTA 2010, s 459( 2) would relate to deal with the loan made to Newco as though it were a loan to a participator within CTA 2010, s 455. Therefore, if it was not settled within the pertinent ‘nine-month’ window, an area 455 fee of ₤ 675,000 (i.e., 33.75% x ₤ 2m) would certainly arise.

On the basis of the current deal structure, Miss Eagle is a participator in Newco. However, even if she did not take shares in Newco as part of her sale factor to consider, she would be a participator because of being a loan lender (CTA 2010, s 454( 2 )( b)).

HMRC continues to verify that where the pertinent problems are pleased, it will look for to apply the CTA 2010, s 459 arrangements.

Making use of dividends to transfer money to Newco

In practice, it is usually feasible to ‘plan out’ of the prospective CTA 2010, s 459 trouble by scheduling the monies to be transferred to Newco via a dividend payment. Appropriate treatments would have to be followed to make sure that the ‘target’ company makes a lawfully compliant dividend. As an example, the target’s directors would certainly require to be pleased that it has enough distributable gets to ‘frank’ the relevant dividend payment.

The dividend cash received by Newco would certainly be exempt from tax in Newco’s hands under CTA 2009, Pt 9A. These cash would after that be made use of to release the acquisition factor to consider payable to Miss Eagle on completion and at later days. However, given that no loan has actually been made to Newco, CTA 2010, s 459 can not use.

Practical tip

Where an upstream loan has actually already been used, a post-acquisition dividend to the new holding company could be utilized to settle the loan prior to the ‘nine-month’ trigger day for the 33.75% tax charge.

Recent Comments