Setting Up A Limited Company?

Simply email

(Salford Tax Specialists – martin@salfordtaxspecialistsltd.co.uk)

and we will commence the company formation guaranteed free of charge.

Or call us on

0161-457-2215

Claim your Free Company Formation now, or if you’d prefer to form the company yourself, see below for our detailed guide.

Forming and registering a limited company in the UK can be frustrating. There are requirements and elaborate steps to be followed. It is true that the UK government has attempted to remove some of the bureaucratic barriers in its effort to make the process simpler. But still, many entrepreneurs who try to set up a limited company in the UK face many challenges. It forces them to seek help from a formation company and pay fees that are usually a lot more expensive than advertised. Salford Tax Specialists are committed to helping potential entrepreneurs to register limited companies free of charge.

We are aware that formation companies charge a fee to have this done. But our goal is to save entrepreneurs from the time and cost by offering the service free of charge.

This article delves into the steps to be followed in setting up and registering a limited company in the UK should you undertake to do it yourself.

Perhaps the only monies you will need to pay to the Companies House to facilitate registration is the mandatory £12.00. You also need to register the company for corporation Tax once it is registered with Companies House. To do this, you need to provide personal information about the shareholders, the guarantor and yourself. Some of the information required includes:

-

Your national insurance number

-

Town of birth

-

Your telephone number

-

Your father’s first name

-

Your mother’s maiden name,

-

Your passport number

Note that you can pay the £12 by credit or debit card. In a case where you don’t intend to use ‘’limited’’, it is mandatory that you register by post.

Also, you can register using a third party software or an agent.

If you chose to register by post, you will do this using form INO1. Also, you will be required to make out a cheque of £40 to the Companies House. It will take about 8-10 days for the postal application to be processed.

To have it registered on the same day, the application should find its way to the Company House before 3 PM and pay £100. Also, the courier envelope must have the words “same day Service” The words must be inscribed at the top of the left-hand corner.

So, What Is a Limited Company?

It is a company that adheres to a defined business structure, but which is distinct from the people running it. The business keeps its finances distinct from the owner’s finances. It can own assets and keep the profit realised after taxation. We have public limited companies and private limited companies. Public companies can raise finance or capital by selling their shares to the public. But private limited companies are not allowed to raise capital through the sale of shares to the public.

Minimum Requirements

To set up a limited company in the UK, there should be a minimum of one appointed director. The entity can have more directors all of who must be over sixteen years old. But the limited company should have its registered office in the United Kingdom and at least one share at the point of incorporation. Also, it may be necessary to appoint a company secretary to help with the administration of the company. It is not mandatory that all the shareholders, the secretary and the directors be based in the United Kingdom. UK laws allow anyone to own or manage a limited company. However, at least one person who is over 16 years should be based in the UK. The address of the directors that includes the street name must be provided. Further, in the UK, corporate entities are allowed to act as shareholders, secretary or directors of a limited company. But, when you use corporate entities, it becomes difficult to open a bank account. Typically, most entrepreneurs appoint a person to serve as director and shareholder. Below is an outline of how to register a limited company.

Setting Up and Registering a Limited Company

It is a seven-step process that includes:

- Deciding that you want a limited company

- Choosing an appropriate name for the business

- Appointing the company secretary and the director

- Choosing the guarantors or shareholders

- Preparing the documents that detail how you will run the company

- Checking out the accounting records that the law requires the company to keep

- Registering it with the Companies House.

Deciding That You Want a Limited Company

Checking whether a limited company is ideal for you is the most important thing. It should be done before you seek to have the company registered. In most cases, the decision is determined by the job you want the business to do or the type of business you plan to run. Also, how the business will be funded could be used to determine whether to set up this type of a company or not. You have other forms of business to consider. But at Salford Accountants, we help entrepreneurs set up and register a limited company free of charge.

Choosing the name of the company

It is the second most important step in setting up the company. In the UK, there are rules that guide entrepreneurs when choosing the name of the company. For instance, your name should not be the same as the name of an existing registered company. Also, the trademark you choose should not be similar to an existing one. If the trademark or the name is similar, you will need to make some changes. Also, the name for a limited company must end with either the words Ltd or Limited at the end. The only exception to this is where you are registering ‘same as name’. ‘Same as name’ is used when the company you are registering is part of a group or an LLP. In such a case, there must be a written confirmation by the company. The company should state that they have no objection to the name you have chosen to use. Even though, the following may be used to differentiate it from an existing company.

- Punctuation

- A character such as a plus sign

- A word that is similar in meaning or appearance to the existing name

If you choose a name, but someone else complains that it is ‘too like’ names, it will need to be changed if the Companies House concurs with them. For instance, names like Easy Coach Ltd and EZ Coach Ltd may be considered ‘too like’. In some cases, the Companies House may advise you on what you need to do to make the name unique.

Also, you should ensure that the name you choose is not offensive. It should neither contain a sensitive word nor anything that connects it with a local authority or government. Of course, an exception to this is when you obtain permission from the authority. Using words such as accredited may need that you get appropriate permissions.

Appointing the Company Secretary and the Director

The UK law requires that you appoint a director. But, it is not necessary that you appoint a company secretary. You must also outline the director’s responsibilities. They include:

- Keeping the company’s records

- Following the company’s rules

- Filing tax returns and accounts

- Keeping the company tax returns

Note that anyone appointed in the position of a director must meet the set requirements. Failure to do so will see them disqualified, fined or even prosecuted.

Also, the directors are responsible for day to day running of the business. They must ensure that the company’s reports and accounts are prepared under the law. They should also be well managed. As earlier indicated, such directors must be over 16 years of age. Their personal information should be availed to the public at the Companies House and must also provide a correspondence or service address. In some cases, the company may use a company secretary to take up the responsibilities of a director. Such persons can serve as the company’s director but not as an auditor. It is illegal to appoint people who have been declared bankrupt.

In a case where the company chooses to have a company secretary, such an action does not release the directors from their responsibility.

Choosing the Guarantors or Shareholders

The Companies House will not register a limited liability company unless it has shareholders or guarantors. The UK law requires that you have at least one shareholder who will also serve as a director. If you choose to have more than one shareholder they will be limited by shares. Such shareholders will enjoy certain rights including voting when making changes in the company.

For companies that are limited by guarantee, the law requires that there should be a guaranteed amount. Furthermore, if the company has ordinary shares, each shareholder will be allowed to cast one vote. It should happen when making important decisions. If the company declares profit in any given trading year, the shareholders will receive dividends based on the number of shares they hold. Note that a company may have as many shareholders as it wishes. It may also choose to have one shareholder that owns a hundred percent of the company. But when registering the company, it is necessary that you provide enough information on the total shares the company has issued. It includes information on the shares issued and its total value. This is what forms the company’s share capital. The company should also have a list of names of its shareholders as well as their addresses. It is also important that you give information on the type of shares issued. Also, information on whether the shares are redeemable should be given. Other details such as voting rights and the number of votes each share is entitled to must be supplied as well. Salford Accountants can offer professional advice which will help you and fellow directors the best way to set the business up that suits your requirements.

Companies limited by guarantee

If you decide to form a company that is limited by guarantee, you should state the guaranteed amount. You must also declare at least one guarantor. The guarantors play a critical role in a limited company. They control the company including making vital decisions. The guarantors do not draw profit from the company but allow their money to be used to finance the operations of the company. Besides, the guarantors agree to help the company pay its debt by paying the guaranteed amount if the company is unable to pay its debts or meet its financial obligations. Thus, the amount guaranteed must be paid in full if the company faces being closed down.

People with Significant Control

The UK law requires that a company appoints PSC (People with Significant Control). They include anyone who owns more than twenty-five percent of the shares issued and who enjoys voting rights. Information of PSC should be filed with the central public register. It helps to increase transparency on ownership and control of companies.

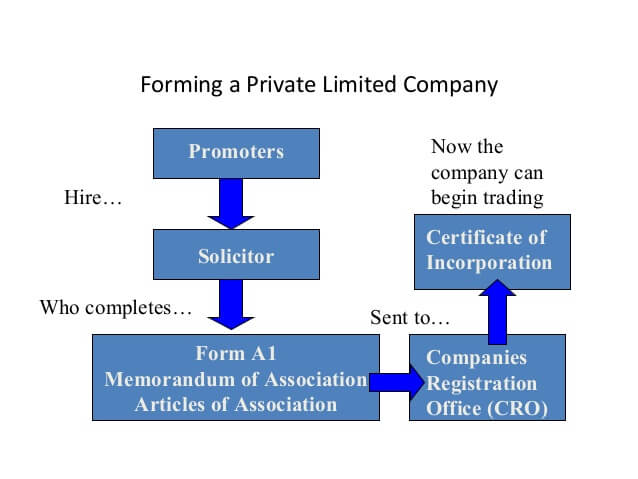

Preparing the Documents That Detail How You Will Run the Company

Preparing the article of association and memorandum of association is mandatory. They are critical documents when seeking registration with the Companies House. These are complex documents and must be complete and set out to meet company’s law.

Memorandum of Association

The memorandum of association must be signed by all the guarantors or the initial shareholders. It is a basic document that forms a limited company. It contains the following critical clauses: the name clause, location clause, objective clause, subscription clause, and the capital clause.

Article of Association

It is another important document that must be prepared before seeking registration. The document contains the rules and regulations that will govern the business’ day to day activities. It contains information on the following aspects:

- The responsibilities and the powers of the shareholders and other members

- The member’s liabilities

- Procedures to be followed when auditing the books of account

- How dividends will be shared

- The rights that accrue to each member

- Procedures for subscription to shares

- Procedures that should be followed when removing or even appointing directors.

Checking Out the Accounting Records That the Law Requires the Company to Keep

It focuses on the company’s records including the accounting records. The law requires that the company should keep its accounting records for not less than 6 years. It ensures that the company pays the correct amount of tax and other obligations as they fall due. Other records that the company must keep are those for directors, the company secretary, and shareholders. They include the resolution made by shareholders and votes. Records on debentures or promises to pay loans and indemnities if things don’t work out must be kept. Also, there must be records on any mortgages that are secured against the assets of the company. Lastly, the Companies House will need to be informed if you plan to keep the records anywhere else other than in the official registered office.

The Companies House will be interested in the following records:

- Records for monies received and spent

- Records detailing the assets that the company owns

- Debts owed to the company and those it owes

- Any stocks the company may own

- The methods used in stocktaking and working out the figure of the stock

- The goods the company may have bought and sold

- Receipts showing the money spent by the company

- The persons who bought and sold the goods

Records on the company’s cash receipts such as invoices, delivery notes, orders, petty cash book must be kept. Also other relevant documents like correspondences and bank statements should be kept.

Registering It with the Companies House

Once all the things discussed above are confirmed to be in order, you will be ready to seek registration with the Companies House. If approved, you will be issued with a registration code that identifies the company and what it does. At this point, you may choose to register for Corporation Tax. You may also seek to register the company with HM Revenue & Customs once the Companies House registers it. Ensure that you register for both PAYE and Corporation tax. But remember that all these other registrations should be done within 3 months of commencing business. Late registration may attract penalties. You will be issued with a UTR number. It is a 10 digit Unique Taxpayers Reference number. Normally the HM Revenue & Customs will post the UTR on the company address 14 days after the company has been incorporated. Salford Accountants can offer full tax advice on all taxation issues.

Conclusion

The process of registering a limited company is, certainly, laborious and time-consuming. Besides, it may seem complicated if it is the first time you are seeking to register a limited company with Companies House. Most entrepreneurs get stuck and are forced to outsource the job to a FORMATION COMPANY at a fee. But at Salford Tax Specialists Ltd, we will help you have the documents in place and assist to have the company registered with Companies House free of charge. We will do the donkey work and go the extra mile to help you get in business as soon as possible.